كيفية فتح حساب Raw Spread تجريبي في شركة exness وهي واحدة من افضل شركات التداول وذلك الشرح من داخل مساحتك الشخصية في دقيقة واحدة.

ولكن هذه الطريقة ستكون من على أجهزة الكمبيوتر التي تعمل بنظام الويندوز مثل( الديسك توب ) كذلك اللاب توب والأجهزة

نصيحة خاصة للمتداولين المبتدئين عليك ان تختار مبلغ الحساب التجريبي والرافعة المالية مقاربة جدا لما سوف تتداول عليه بعد ذلك في الحساب الحقيقي.

سابقاً قدمنا شرح فتح حساب Zero تجريبي في شركة exness.

فتح حساب Raw Spread تجريبي في exness

أولاً سجل الدخول إلى المساحة الشخصية لحسابك في شركة اكسنس.

ومن قسم حساباتي قم بالنقر على كلمة فتح حساب جديد كما هو موضح في الصورة التالية.

بعد ذلك إختار من بين خمسة أنواع من الحسابات التي توفرها شركة exness حساب الرو .

وهو واحداً من أفضل حسابات الخبراء ( المتداولين المحترفين ).

وهو متوفر على منصة MetaTrader 4 كذلك متوفر على منصة MetaTrader 5.

كذلك حدد نوع المنصة وبعد ذلك أنقر على أيقونة متابعة كما هو موضح في الصورة التالية.

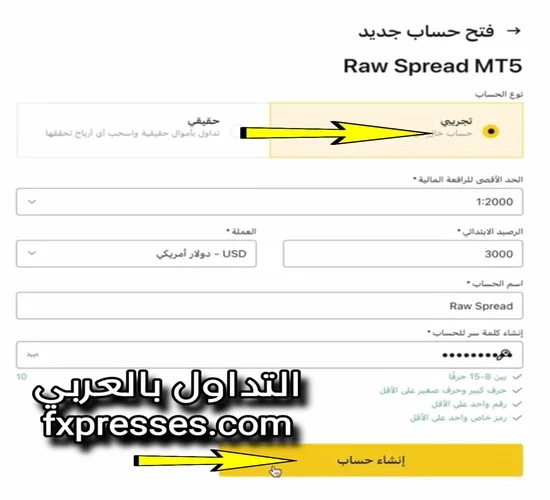

تنتقل بعد ذلك ندخل علي إلى ضبط إعدادات الحساب حساب Raw Spread تجريبي الجديد مثل:

إختيار نوع الحساب تجريبي كذلك اختار الحد الأقصى للرافعة المالية في exness.

وعلمة حسابك ويفضل أن تكون الدولار الامريكي مع العلم انه هناك الكثير جداً من عملات الحساب المتوفرة في شركة اكسنس.

كذلك قم بتعيين كلمة سر الحساب وهي التي تدخل بها إلى منصة ميتاتريدر وهي مختلفة عن كلمة سر الدخول إلى حسابك الشخصي في شركة اكسنس.

مع العلم بأن تكون كلمة السر مكونة من 8 الي 15 ما بين حروف انجليزية صغيرة وكبيرة وأرقام و رموز.

بعد ذلك قم بالنقر على كلمة إنشاء حساب كما هو موضح في الصورة التالية.

بذلك تم فتح حساب Raw Spread تجريبي جديد من داخل مساحتك الشخصية في اكسنس وستصل إلى بريدك الإلكتروني رسالة بها تفاصيل حسابك.

تهانينا ستجد الحساب الجديد ظهر في تبويب حساباتي في مساحتك الشخصية في ثواني كما هو موضح في الصورة التالية.

فيديو فتح حساب الرو سبريد التجريبى فى اكسنس

فتح حساب اسلامي مع شركة EXNESS

الفيديو متاح على قناة اليوتيوب

قناة الموقع على YouTube

قناة الموقع على TikTok

أخيراً إذا كان الموضوع قد افادك فبرجاء المشاركة عبر ايقونات مواقع التواصل الاجتماعي ليستفيد الجميع.

كذلك إن كان هناك اى استفسار فلا تتردد فى كتابته في مربع التعليقات وسنقوم بالرد عليه ونشره ان شاء الله

مواضيع ذات صلة

فتح حساب تداول جديد من تطبيق exness trader شرح بالفيديو

كيفية إعداد تطبيق exness trade شرح بالفيديو

تجربة عملية للسحب الفورى من exness