شرح بالفيديو والصور طريقة فتح حساب Extra تجريبي في الشركة الأسترالية XS في ثواني معدودة من داخل مساحتك الشخصية في شركة إكس إس.

ولكن هذه الطريقة ستكون من على أجهزة الكمبيوتر ( الديسك توب ) وكذلك اللاب توب والأجهزة اللوحية فقط .

قبل كل شيء عليك أن تعلم أنه يجب أن تكون قد قمت مسبقاً بالتسجيل في شركة XS و أنك قد قمت بالتحقق من حسابك كاملاً.

مثل التحقق من البريد الإلكتروني والتحقق من السكن والتحقق من الهوية في الشركة كذلك التحقق من الهاتف الجوال.

سابقاً تم شرح كيفية فتح حساب Pro تجريبي في شركة XS الأسترالية، وأيضاً تم شرح طريقة فتح حساب Elite تجريبي في شركة XS الأسترالية، كذلك فتح حساب ستاندرد تجريبي.

وأخيراً تم شرح كيفية فتح حساب Classic تجريبي في الشركة الأسترالية XS.

كيفية فتح حساب Extra تجريبي في الشركة الأسترالية XS

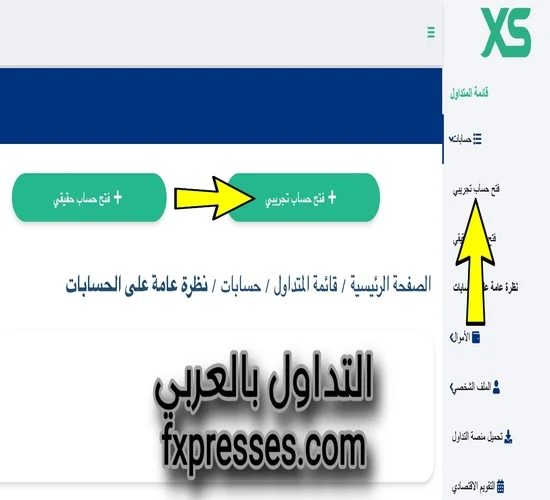

اولاً قم بتسجيل الدخول إلي المساحة الشخصية الخاصة بك لدى شركة اكس اس

بعد ذلك من القائمة الجانبية على اليسار أو القائمة العلوية.

أنقر على كلمة Open Demo Account أو ( فتح حساب تجريبي ) كما هو موضح في الصورة التالية.

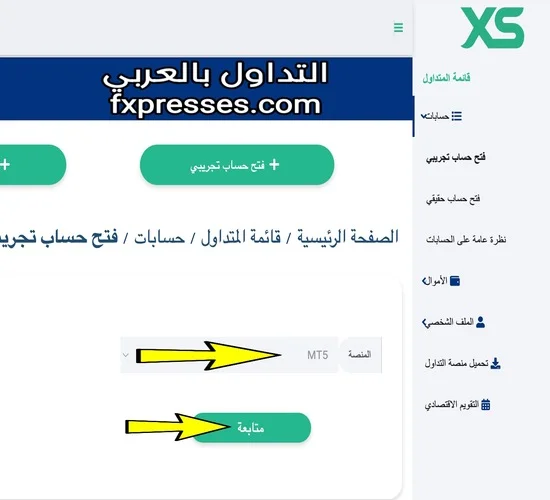

بعد ذلك إختار منصة التداول MT5 أو منصة التداول MT4 كما تريد علي الرغم من أنى أفضل منصة MetaTrader5.

بعد ذلك قم بالنقر على كلمة Continue ( متابعة ) كما هو موضح في الصورة التالية.

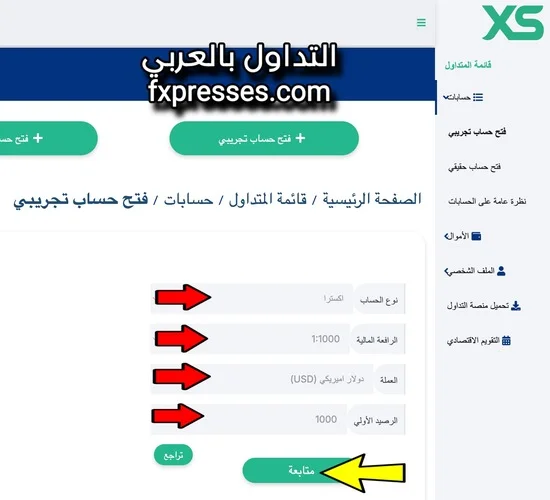

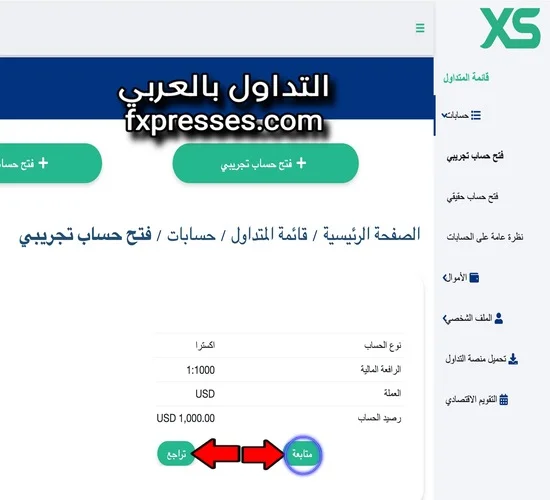

تنتقل بعد ذلك إلى صفحة إعدادات الحساب وتختار منها حساب Extra إكسترا تجريبي كذلك اختار الرافعة المالية في شركة XS.

علماً بأن أقصى رافعة مالية للحساب التجريبي هي 1:1000 وأخيراً عملة الحساب USD.

ولكن إذا كنت ترغب في تعديل الاختيارات قم بالنقر على كلمة تراجع ( Back ) وإذا كنت راضىً عن اختياراتك قم بالنقر على كلمة Continue ( متابعة ) كما هو موضح في الصورة التالية.

بعد ذلك تنتقل إلى صفحة مراجعة حسابك التجريبي فقم بالنقر على كلمة Continue ( متابعة ) كما هو موضح في الصورة التالية.

وأخيراً تنتقل إلى صفحة معلومات الحساب ، عليك أن تقوم بطباعتها أو كتابتها في مستند والاحتفاظ بها كما هو موضح في الصورة التالية.

وفي كل الأحوال سيتم إرسال بيانات وتفاصيل حسابك إلى البريد الإلكتروني الخاص بك المسجل في شركة شركة XS الأسترالية.

تهانينا تم فتح حساب إكسترا بنجاح في شركة اكس اس

فيديو كيفية فتح الحساب من المساحة الشخصية

فتح حساب إسلامي في الشركة الأسترالية XS

الفيديو متاح كذلك على قناة الموقع على اليوتيوب

قناة الموقع على YouTube

قناة الموقع على TikTok

أخيراً إذا كان الموضوع قد افادك فبرجاء المشاركة عبر ايقونات مواقع التواصل الاجتماعي ليستفيد الجميع.

كذلك إن كان هناك اى استفسار عن طريقة فتح حساب Extra إكسترا تجريبي في الشركة الأسترالية XS.

فلا تتردد فى كتابته فى مربع التعليقات وسنقوم بالرد عليه ونشره ان شاء الله.

والتأكد من الرد على تعليقك قم بالتأشير على المربعين قبل الضغط على إرسال التعليق.

مقالات ذات صلة

تحميل كتاب التحليل الفني للبورصة ريتشارد سكاباكر

تحميل كتاب كوتلر يتحدث عن التسويق بصيغة pdf مترجم إلي اللغة العربية